Personal finance software that

respects your data

CountAbout is a private, ad-free budgeting and money management app. Import from Quicken & Simplifi, sync accounts, and keep your complete financial history in one place.

Simple, powerful, and yours

A modern Quicken alternative with the flexibility power users want, without ads, tracking, or data selling.

Flexible

Build a budget that matches your life with unlimited custom categories, splits, and powerful planning tools.

Compatible

Import from Quicken and Simplifi, then keep everything in one place. Add unlimited accounts and track long-term history.

Private

Subscription-supported and ad-free. Your financial data is never sold, mined, or shared.

Built for budgeting, planning, and long-term control

Powerful features without the bloat, ads, or privacy trade-offs.

Bring Your Financial History

Import from Quicken or Simplifi and keep every year of your data. Some customers maintain transaction history going back decades.

Automatic Transaction Sync

Connect US and international accounts for automatic downloads. Create rules to categorize transactions automatically.

Projected Register Balance

See future account balances on any date based on scheduled transactions, so you can plan ahead with confidence.

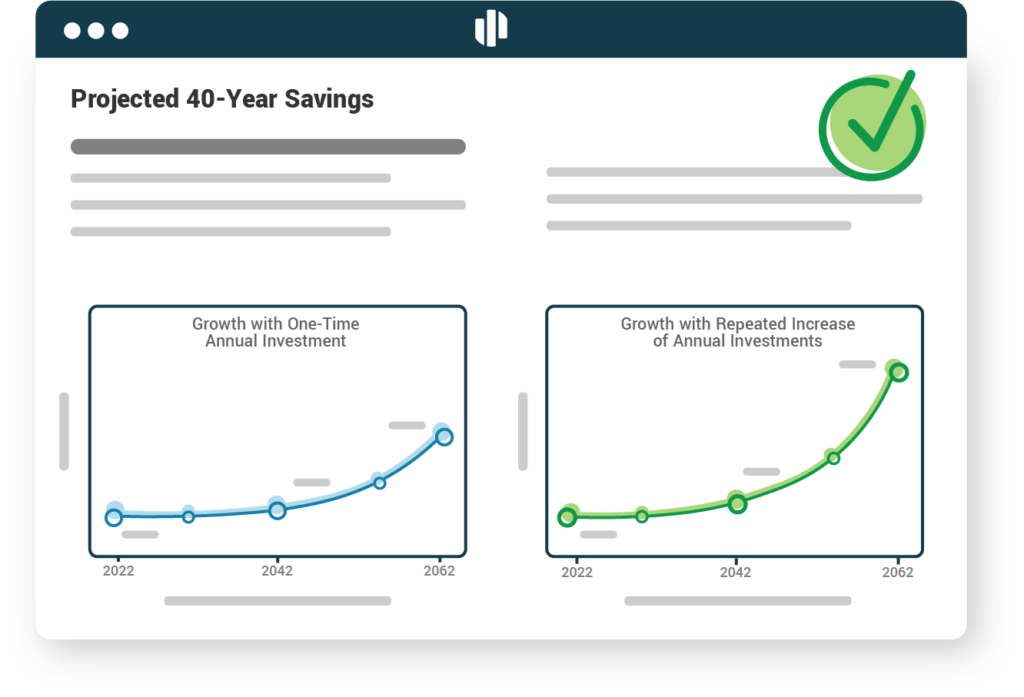

Savings Projections

Model how changes in spending or savings impact long-term outcomes. Loan amortization tools coming soon.

Loan amortization coming soonReporting You Can Trust

Run detailed reports across any date range to understand trends, reduce overspending, and make better decisions.

Ad-Free by Design

No advertising. No behavioral tracking. No data selling. CountAbout is supported by subscriptions, not surveillance.

Unlimited Categories & Splits

Create as many categories as you need and split transactions across multiple categories for accurate budgeting.

Receipts & Attachments

Attach receipts and documents to transactions for taxes, warranties, reimbursements, and business records.

Schedule C & E Tracking

Track business and rental activity with features designed for how the IRS expects categories to be organized.

Made for households, military families, civic organizations, and small businesses

Whether you want simple budgeting, full account sync, or a privacy-first tool that keeps your data out of the ad ecosystem, CountAbout adapts to how you manage money.

Households

Budgeting, reporting, and planning tools for individuals and families who want a full financial picture without ads.

Military Families

Active military members receive a free Basic plan as our way of saying thank you for your service.

Free for active militaryChurches & civic organizations

Track categories, budgets, and reporting with flexible tools that work for organizations and community groups.

Small Businesses & Landlords

Schedule C & E support, attachments, and reporting for freelancers, self-employed users, and rental property tracking.

See how changes today affect your future

Use projections to model savings goals and cash flow over time, then use scheduled transactions to stay ahead.

Try it free →

See every account in one place

Connect US and international banks, credit cards, mortgages, loans, and investments. Transactions download automatically and rules categorize them for you.

Start free trial →

Your budget, your categories, your data

Create unlimited categories and split transactions across them. CountAbout will never sell or mine your data.

Get started free →

Built for people who want control without compromises

CountAbout is a good app. I especially like the Projected Register Balance calendar. It helps me plan my budget and is the main reason I chose the app.

I use the web application every day and have for many years. I have banking data in CountAbout that goes back decades. The ability to import my Quicken data was huge.

I’ve been trying to ditch Quicken for years. Finally a worthy replacement — clean, intuitive, and private.

Compare CountAbout to YNAB, Simplifi, Monarch, and EveryDollar

CountAbout includes premium capabilities at a lower price, plus unique tools like Projected Register Balance and Quicken/Simplifi import.

| CountAbout | YNAB | Goodbudget | PocketGuard | EveryDollar | Simplifi | Monarch | Empower | Fudget | |

|---|---|---|---|---|---|---|---|---|---|

| Annual Price | $54.99 | $99 | $70 | $79.99 | $99 | $71.88 | $99.99 | Free* | $19.99 |

| Free Trial | 45 days | 34 days | 30 days | None | 14 days | 30 days | 7 days | N/A | None |

| Import from Quicken | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Import from Simplifi | ✓ | ✗ | ✗ | ✗ | ✗ | — | ✗ | ✗ | ✗ |

| Ad-Free | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Custom Categories | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ |

| Projected Register Balance | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Receipt Attachments | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Schedule C & E Tracking | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Small-Business Invoicing | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Free for Military | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

| Investment Balances | ✓ | ✗ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ |

* Empower is free but generates revenue through financial advisory services.

Clear pricing, better value

Start with a 45-day free trial of all features — including automatic bank sync, attachments, and invoicing. Then choose the plan that fits.

- Manual transaction entry

- Unlimited accounts

- Unlimited custom categories

- Split transactions

- Budgeting tools

- Projected Register Balance

- Savings projections

- Schedule C & E tracking

- Everything in Basic

- Automatic transaction sync

- US & international banks

- Auto categorization rules

- Investment account tracking

- Schedule C & E tracking

- Full Basic plan — no expiration

- Manual entry & unlimited accounts

- Budgeting & reporting tools

- Projected Register Balance

- Schedule C & E tracking

- Upgrade to Premium anytime

All plans include a 45-day free trial of every feature. Active military receive Basic free permanently — no trial period or credit card required.

Take CountAbout with you

Available on iOS and Android. Your budget, wherever you are.

Try CountAbout free

for 45 days

Import your history, connect accounts, and keep full control of your data with private, ad-free personal finance software.

Start Your Free TrialNo credit card required · Cancel anytime · Active military always free