by Saundra Latham, The Simple Dollar

There’s more than one way to mind your money online.

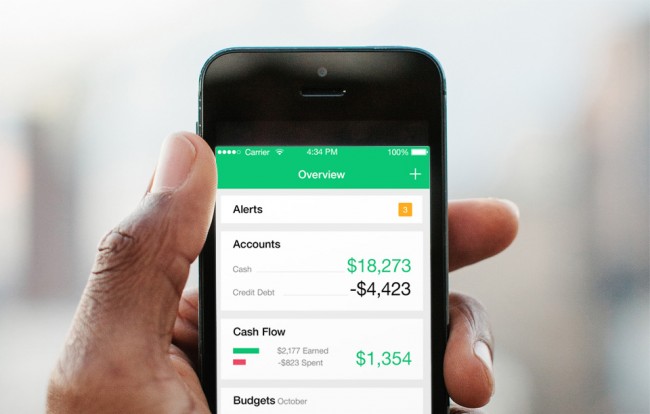

Since its founding in 2006, Mint.com has grown from a small financial startup into a formidable personal finance tool with more than 15 million users. Acquired by Intuit in 2009, Mint has become the budgeting go-to for tech-savvy consumers who want a convenient place to manage their money on the go. You can use Mint via its website or apps made for iOS and Android devices.

Despite its massive following, however, Mint has some drawbacks. We’ll take a closer look at them in this article, and recommend a few alternatives in case your love affair with the site has cooled, or you simply want a service with a slightly different approach.

A Quick Overview of Mint.com

What can you do on Mint? If you’re unfamiliar with the site, here’s an overview of the main features:

- Stay on top of your budget: Mint lets you see where your money is going with a quick glance. Once you know your spending patterns, you can set up a budget to help you meet your goals, dialing back spending in one area to save in another.

- Free credit score: Your credit score can have a huge impact on your financial freedom, so it’s important to know where you stand. (Note, however, that the score you’ll get from Mint is not your FICO score, which is based on your credit reports from all three credit bureaus and is the one most lenders check. Mint’s score uses information from Equifax only.)

- Custom alerts: Mint can tip you off if you’re overspending, wasting too much money on ATM fees, or approaching an important bill due date. It can also let you know if there’s an unusual transaction that could be fraudulent.

- Pay bills: With Mint Bills, you can pay whomever you owe with a couple of clicks by hooking up a bank account or credit card.

- Track investments: Wherever you’ve stashed your money — 401(k)s, IRAs, mutual funds, brokerage accounts — you can see how it’s performing compared to market benchmarks. You can also keep an eye on fees and get advice on asset allocation.

- Track your net worth: Mint integrates all of your assets and debts to keep a running tally of your net worth — one of the best gauges of your overall financial progress. If you’re a homeowner, it will even factor in your home’s estimated value (via real estate website Zillow) and remaining mortgage debt.

How Mint.com Makes Money

It’s free to sign up for an account on Mint.com, and unlike many other competitors, there are no premium accounts that require a fee for you to unlock more features. Mainly, the site makes money when you sign up for some of the sponsored services it recommends, such as checking accounts, brokers, or credit cards. When you use these services, Mint.com gets a referral fee for being the middleman.

According to Investor Junkie, Mint.com has also recently started running banner ads, which are typically pay-per-click. The site also sells its deep pools of financial data to different providers, but it’s important to note that this information doesn’t contain users’ personal information — it is aggregate information about users’ financial habits on the whole.

Downsides of Mint.com

For a free service, Mint is fairly robust. But it’s aging — not gracefully, many say — and has some drawbacks that have sent some users searching for an alternative:

- Categorizing transactions can be clunky: Mint automatically funnels your transactions into categories such as entertainment, transportation, and food and dining. Unfortunately, the process is far from seamless and users say they often have to change where their transactions end up manually.

- Data synchronization hiccups: Many Mint users, including some here at The Simple Dollar, have had trouble keeping their various bank accounts synced with the service, sometimes experiencing lags of up to a week.

- Ads and suggested services: As we discussed above, this is how Mint keeps its services free. But some users complain that all the advice they receive on Mint is tied to a sponsored service.

- Weak investment feature: If you’ve invested any amount of money, you may be underwhelmed at Mint’s investments feature. Though you can see where your money is, you can’t do much with it since there is no way to manage asset allocation.

- Reporting isn’t that great: You can’t generate any reports or financial statements via Mint. The only functionality in this area is the ability to export transactions using a CSV file that you can open in Excel.

- Weak customer service: With a free product, customer service is typically one of the first areas to suffer, and several reviewers say Mint needs improvement here. If you need help, you can browse a community forum or fill out a Web form for a personalized response, which Mint says should come within 24 hours. There is also a chat feature. However, there is no phone support for immediate answers.

- Security fears: Mint.com touts its triple-layer security, which includes bank-grade 128-bit SSL data encryption and a mobile PIN. But the fact remains that when all of your financial data is laid bare and synched with the institutions themselves in one place, a cyber breach could be very damaging. You could also be liable for any losses, depending on whether your financial institutions prohibit you from sharing your account information with third-party sites.

- Lacks running register: Without a running register, you really don’t know exactly how much money you have at any given moment, since transactions take time to clear.

Alternatives to Mint.com

One of Mint’s longtime alternatives is Quicken, but its future is currently up in the air. Intuit announced in August that it would try to find a buyer for the well-known desktop-based personal finance software, once the bedrock of Intuit’s business. Mint, owned by Intuit, is well-positioned to snap up some of Quicken’s users, but it’s not as fully featured and (like most alternatives) doesn’t allow users to import Quicken data.

Fortunately, whether you’re jumping ship from Quicken or simply want a different feature set than Mint offers, there are a lot of alternatives. Here are three of the best:

CountAbout

CountAbout set out to specifically address some of the shortfalls of services such as Mint.com. For instance, it offers a running register balance, and it’s one of the few services that lets you import data from Quicken.

It uses a paid-subscription business model, so you won’t see any ads or be pitched any services. In addition, CountAbout pledges not to sell your data to anyone, and stores only your email address on its servers.

“CountAbout can import users’ historical Quicken data, so users can pick up with CountAbout where they left off with Quicken,” says Joseph M. Carpenter, CountAbout co-founder. “Additionally, since we are using Intuit (makers of Quicken and Mint) to connect our users to their financial institutions, any account that you can connect in Quicken or Mint can be connected in CountAbout.”

Here’s a sampling of CountAbout’s features:

- Track detailed budgeting and expenses

- Automatically download transactions

- Customize your spending and saving categories, searches, and reports

- Know exactly what you have with running register balances

- Easily import Quicken, Quicken for Mac and Mint data

- No advertising, hidden fees, or forced upgrade charges

A basic CountAbout account will set you back $9.99 a year, while a premium version costs $29.99 a year. The difference between the two: With a basic account, you won’t get automatic downloading of banking, credit card, and other transaction information that you will with a premium account.

If you’re commitment-shy, you can try out a premium CountAbout account for free for 15 days. You can access CountAbout via its website or apps made for iOS and Android devices.

Find a Budgeting Tool You’ll Stick With

In the end, any of the budgeting services we’ve mentioned here are worthy competitors to Mint.com. If you need more help deciding on the best financial planning programs and apps, check out some of our past articles on the topic:

- Choosing a Budgeting System That’s Right for You

- 3 Apps for America’s Money Management Woes

- Best Debt Repayment Tools and Apps

- Startups to Help You save Money and Manage Your Finances

- How to Use Technology to Start Saving More

Read full article here>>