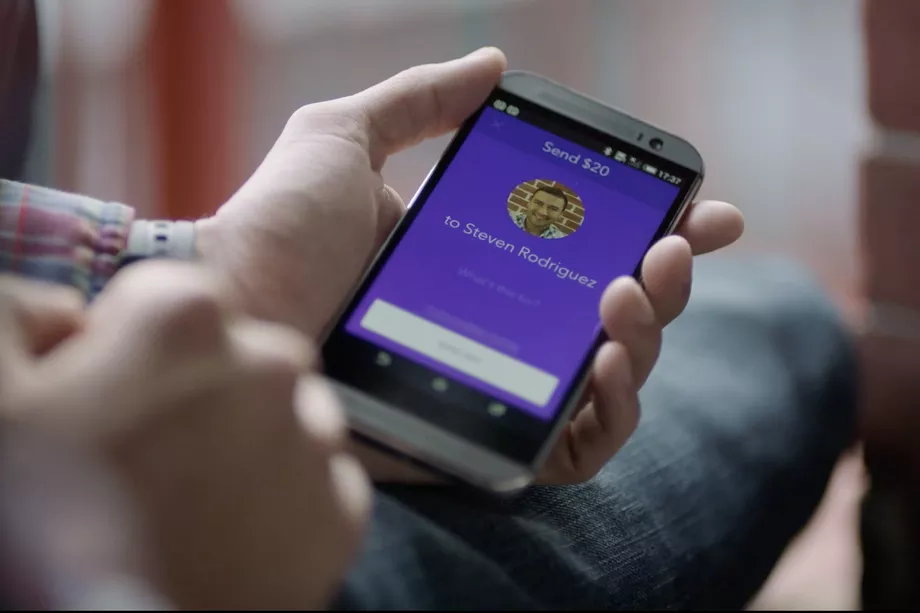

After months of speculation, America’s biggest banks tonight announced Zelle, a money-transfer app they are backing that will compete against PayPal, Venmo and Square Cash.

The service was previewed at the Money 20/20 payments conference in a brief presentation by executives from the bank-owned company, Early Warning, that is developing the service.

The Zelle app is built atop a bank-owned payments network that connects the country’s five biggest banks — and others — including Chase, Citi and Bank of America. Users of Zelle are expected to be able to send money via their phones to recipients who will gain access to the funds immediately.

Zelle will launch next year into a crowded field of competitors, but execs are hoping the speed of the service helps it stand out. Square Cash, a competing service, charges a fee for instant deposits. Other services don’t offer instant deposits at all.

One would imagine that the big banks see the service as a way to both keep up with the times and re-engage customers who are finding fewer reasons to visit bank branches and use other traditional banking services.

Some of Zelle’s partnering banks, like Chase, already operate their own branded money-transfer services such as Chase QuickPay. It’s not yet clear whether brand names like that will continue to exist or fold in favor of Zelle.

Source: