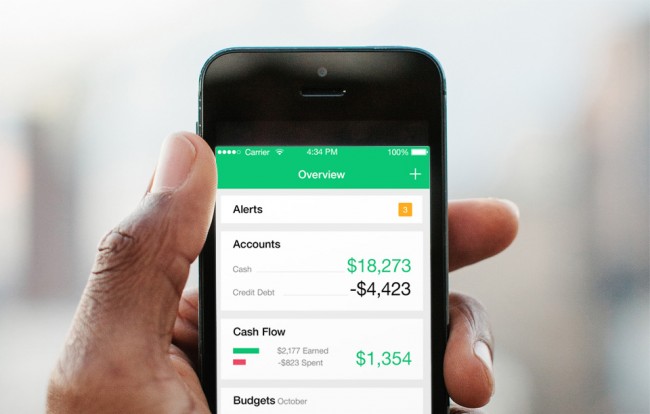

Pleased to be listed as one of the best alternatives to Quicken and Mint by The Simple Dollar. Read the full article to find out why.

Blog

CountAbout Reviewed in “The Simple Dollar”

Thanks Saundra Latham of The Simple Dollar, for including us in your terrific article “Personal Savings Calculator”. We’re honored to be listed as a top personal finance software to be used for budgeting.