For years, computer users have been told they should have complicated passwords, including numbers, punctuation marks and other symbols, and upper- and lowercase letters. #personalfinance

Blog

4 steps to ace a fall financial checkup

Now’s the time to check in on your 2017 financial plan. Here are four steps to take and save money before the end of the year. #personalfinance

Taking Over Your Aging Parents’ Finances

In the year 2011, the Baby Boomer generation started turning 65. Over the next 13 years, 10,000 Boomers will reach retirement age every day. #personalfinance

One surprising way money can buy happiness, according to scientists

People who buy time by paying someone to complete household tasks are more satisfied with life. #personalfinance

What do you need to do to retire with $1 million?

What do you need to do to retire with $1 million? Whatever you end up saving will help. It’s better than not saving anything.

Why Can’t Americans Ditch Checks?

In an era of smartphones, online banking, and Venmo transfers, the rest of the world has weaned itself off paper. #personalfinance

Six-figure income and they can’t make ends meet

Six-figure income and they can’t make ends meet #personal finance

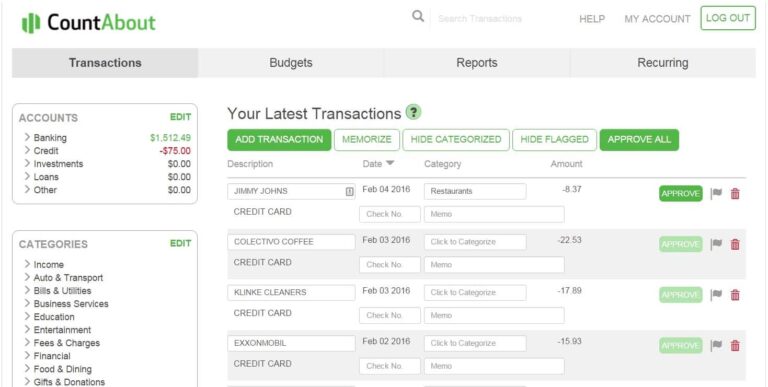

PCMech Quicken alternatives

Quicken alternatives that’ll make managing your finances so much easier. @quicken,#personalfinancesoftware

How to Keep Personal Data Safe When Traveling

Distracted travelers are more vulnerable to card fraud and identity theft. #personalfinance